Right Fit Revolution

Don’t Overpay for College

4 College Money Talks That Protect Your Child’s Future and Strengthen Your Bond

How to Use These Scripts

Talking about money with your teenager might not be high on your “fun things to do today” list. But when it comes to college, it’s one of the most important conversations you’ll ever have.

This is one of the biggest financial and emotional decisions your family will ever make.

Most parents assume their kids understand what college will cost — but according to a Fidelity study, over a third haven’t talked to them about student debt, and one in four haven’t discussed total costs at all.

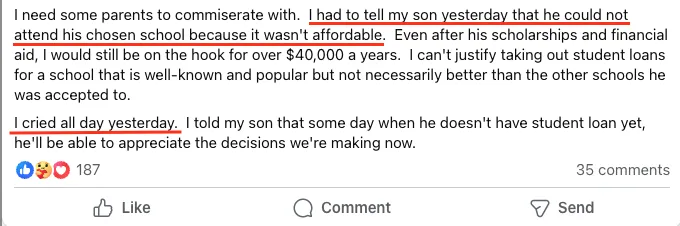

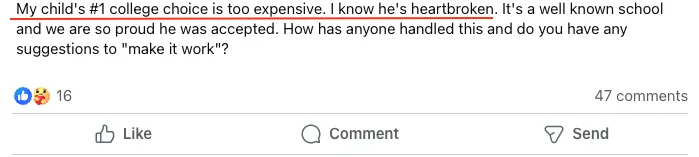

This guide is here to change that. We understand these aren’t easy conversations to have, but here’s what’s at stake without having them…

This is exactly the kind of heartbreak we’re here to help you avoid.

You don’t have to wing it or go it alone. With the right language, the right timing, and the right mindset, these talks can do more than prevent future heartbreak.

They can bring you and your child closer.

They help your child feel included, respected, and empowered to make smart choices about their future.

We know this, because we’ve had these conversations with our own kids, and something surprising happened: they relaxed.

Once they understood that most colleges accept most students — and that they didn’t have to fight for one of a few coveted spots at the same 25 “top” schools as everyone else — their stress rapidly melted away.

They didn’t feel like their future hinged on getting into one “dream school” with a prestige price tag.

They had options. They felt in control. And they started getting excited to see which schools would compete to win them over.

That shift changed everything — for them and for us.

That’s what these talks can unlock:

A calm, clear-headed college search

A smarter financial future

And the kind of connection that happens when you tackle something important, together

Quick Tips for Success

A few tips before you begin:

Start by letting your child read the No-Regrets Guide to Choosing a College: a guide written just for them, with bite-sized takeaways to get you all on the same page.

Let your teen pick the time for each subsequent conversation so they don’t feel ambushed.

Sit side-by-side instead of across from them — it lowers the stakes and keeps things collaborative instead of confrontational.

Keep it short, grounded, and honest. No lectures. No panic. Just facts and love.

Each script in this guide is designed to help you talk through real costs, financial limits, and smart choices… in a way your teen can actually hear.

You’re doing this for the right reasons. And all of your future selves will thank you for it.

Let’s dive in.

Get Your Scripts

Sources Consulted

Fidelity Investments, 2023 College Savings and Student Debt Study.

Gallup, Great Jobs, Great Lives: The Gallup-Purdue 2014 Index Report.

College Board.

First National Bank and Trust.

Sallie Mae.

U.S. Department of Education.

US News & World Report.

EducationData.org.